malaysian taxation question and answer

These 55 solved Taxation questions will help you prepare for personal interviews and online selection tests during campus placement for freshers and job interviews for professionals. Income Tax is paid at 30 of taxable income.

Question Regarding Tax Residence Status For Tax Clearance R Malaysia

During reading and planning time only the question paper may be.

. To maintain economic stability C. TAXATION IN MALAYSIA 2020 ANSWER ALL QUESTIONS Explain the theory of Double dividend of taxation. Marginal Relief in Surcharge.

Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. Malaysian taxation question and answer nov 2019 question and answer part 1. They stay together in Malaysia.

30 MINUTES Mr Lee is a Malaysian citizen and he got married to his wife an Australian. Question and Answer of Finance and Taxation Credit Management Programme Credit Management Programme CREDIT MANAGEMENT PROGRAMME 1. It depends on the creditors.

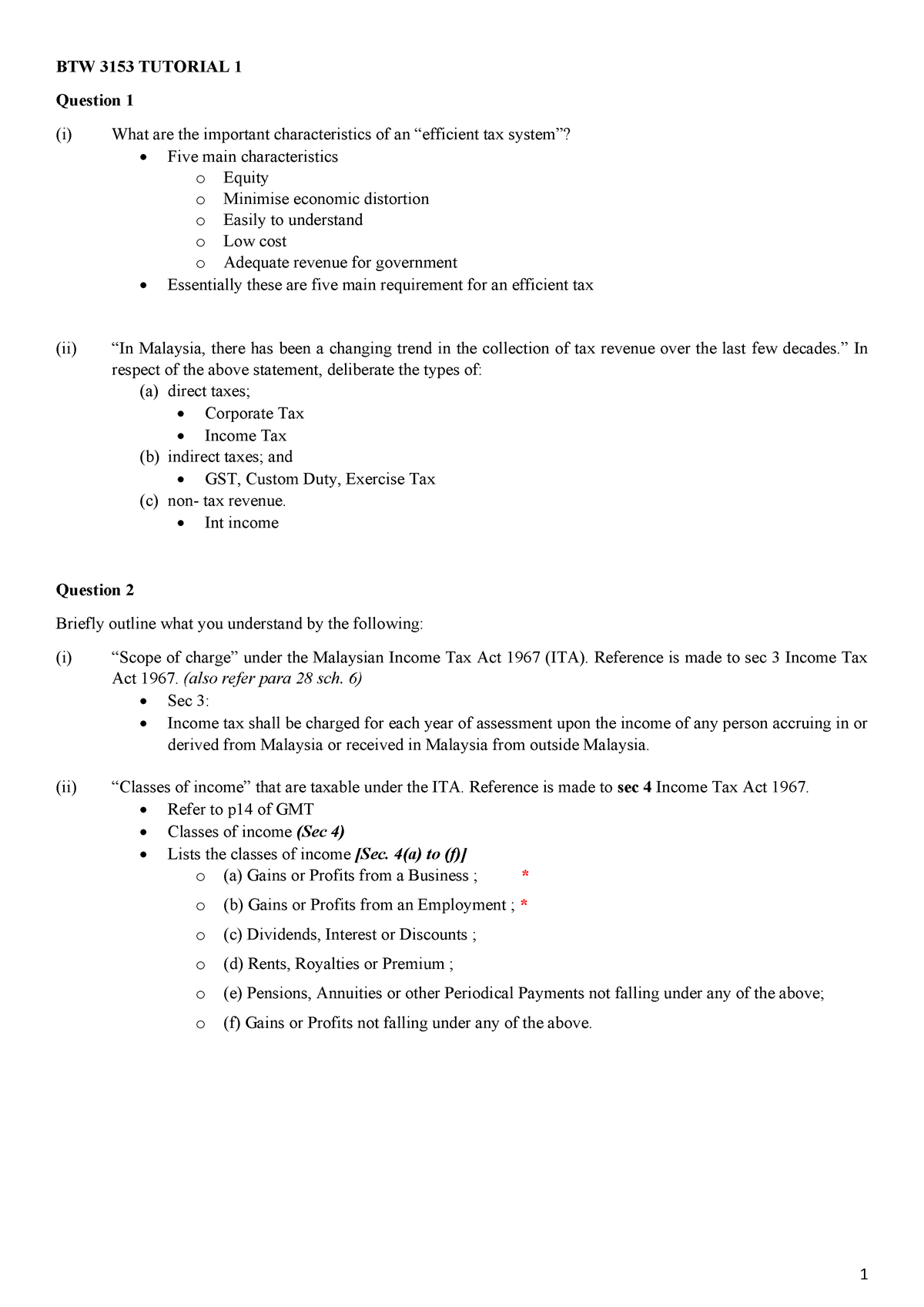

Raising revenue for the state B. MALAYSIAN INCOME TAX LAWANSWERS TO TUTORIAL QUESTIONS 2015 Week 2 - Q1 - 5. There are only two history of Malaysia Taxation are Income Tax Ordinance 1947 and Sarawak Inland Revenue Ordinance 1960.

Questions and Answers 1. To remove disparities in the. Past Year Question - MIA Qualifying Examination - September 2019.

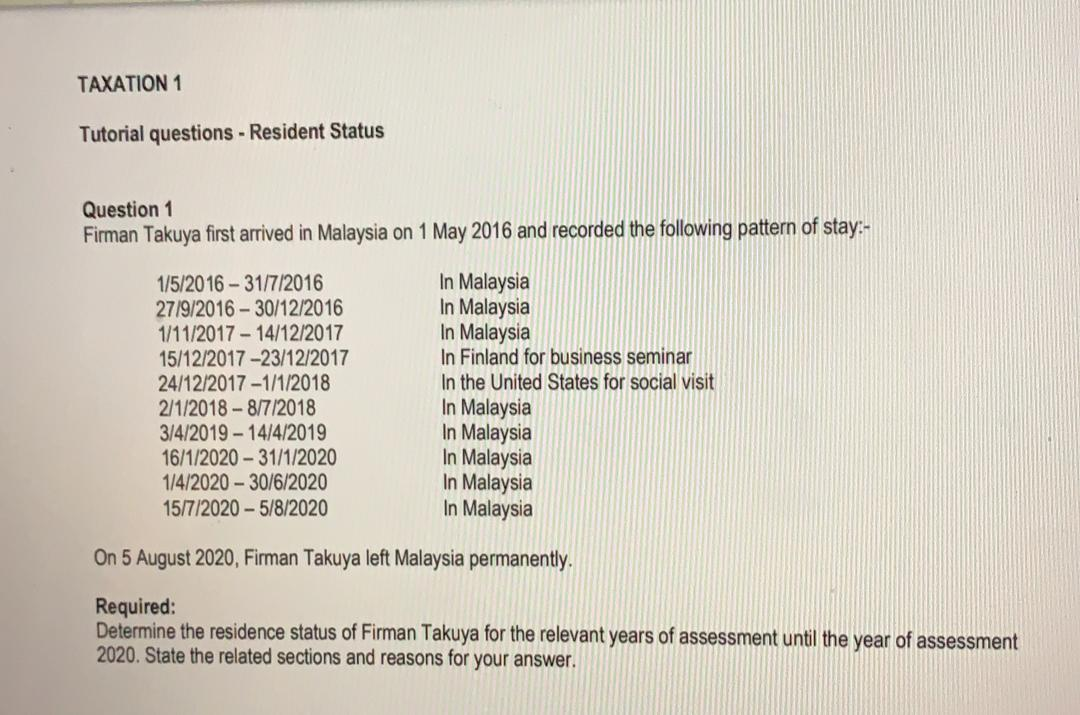

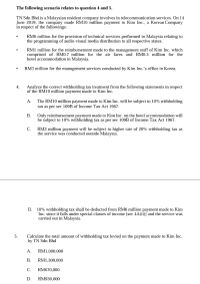

The objective of taxation by the Government are - A. 8 marks Provide the exception to the rules of determining the scope of the. Resident status is determined by reference to the number of days an individual is present in.

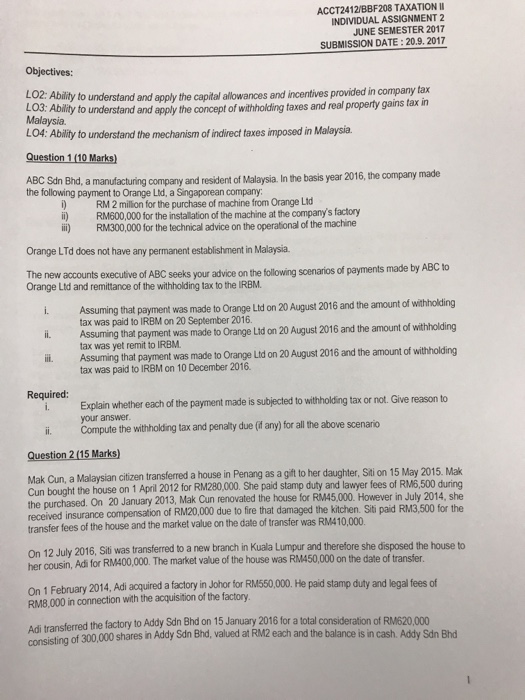

Business Taxation Multiple Choice Questions INCOME TAX ACT 1961 1. 3 hours 15 minutes. Accounting questions and answers.

Sorry this Digital Service is available to authorized users only Close. Surcharge is charged at 10 of the Income Tax where taxable income is more than Rs. What is the Debt.

Section A ALL 15 questions are. Income tax is collected on all types of income except. Taxability of his income earned for all the relevant year of assessment.

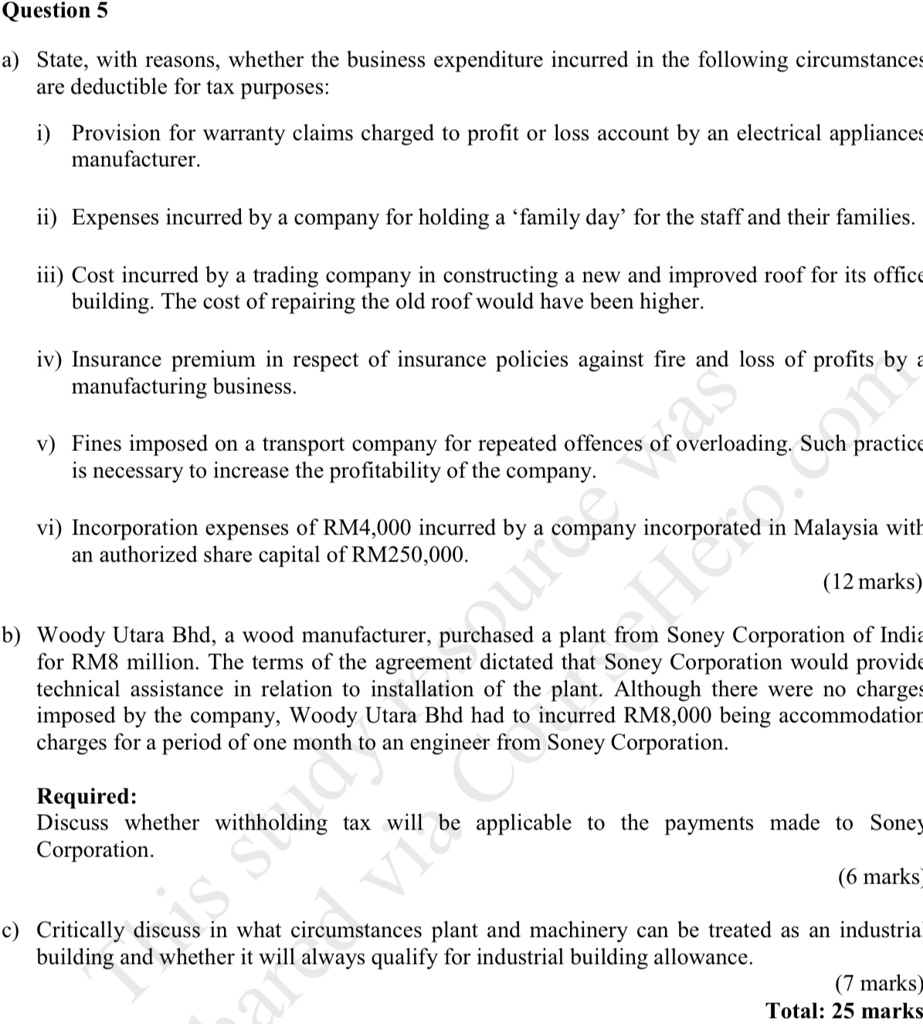

MALAYSIAN INCOME TAX LAWANSWERS TO TUTORIAL QUESTIONS 2015 Week 2 - Q1 - 5 Question 1 a i Scope of charge sec 3 - Lays out the tax net for Malaysia- p. Malaysian taxation question and answer nov 2019 question and answer part 1. Do NOT open this question paper until instructed by the supervisor.

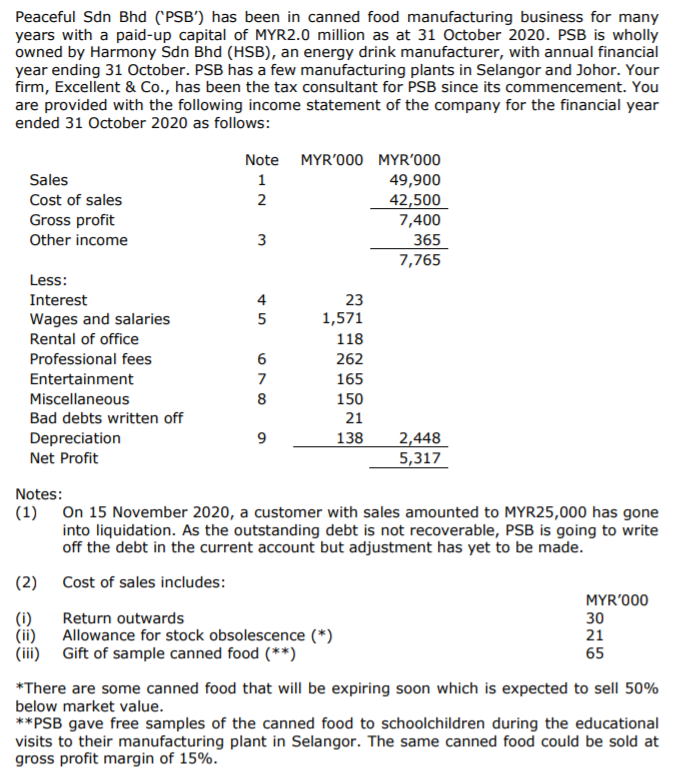

A tax that takes a larger percentage from high-income earners than it does from low-income earners is called A proportional tax B progressive tax C regressive tax D. This question paper is divided into two sections. The Income Tax Act 1967 as amended is referred to as ITA.

Expert Answer Answer 1. Nevertheless before the creditor files a bankruptcy notice in court. TAX RATES AND ALLOWANCES The following tax rates allowances and values are to be used in answering the questions.

Taxation Malaysia MarchJune 2018 Sample Questions. Each answer should begin on a separate answer booklet. The Malaysian Insolvency Department has no jurisdiction over this matter.

Rates of tax and tables are printed on pages 24. All income accrued in derived from or remitted to Malaysia is liable to tax. All workings MUST be shown as.

Assume that the gross income of Shukri under S 13 1 a is RM 48000 the value of accommodation to be taken is 3 based on his gross income under 13 1 a. 15 Questions Show answers Question 1 30 seconds Q. Income tax rates Resident individuals Chargeable income Rate.

QUESTION 2 10 MARKS.

Property Tax In Malaysia And South Africa A Question Of Assessment Capacity And Quality Assurance Semantic Scholar

Questions Answers On Covid 19 Tax Changes For 2020 The Law Offices Of Tyler Q Dahl

Taxplanning International Tax Issues During The Pandemic The Edge Markets

How To Build A Faq Page Examples Faq Templates To Inspire You 2022

Solved Taxation 1 Tutorial Questions Resident Status Chegg Com

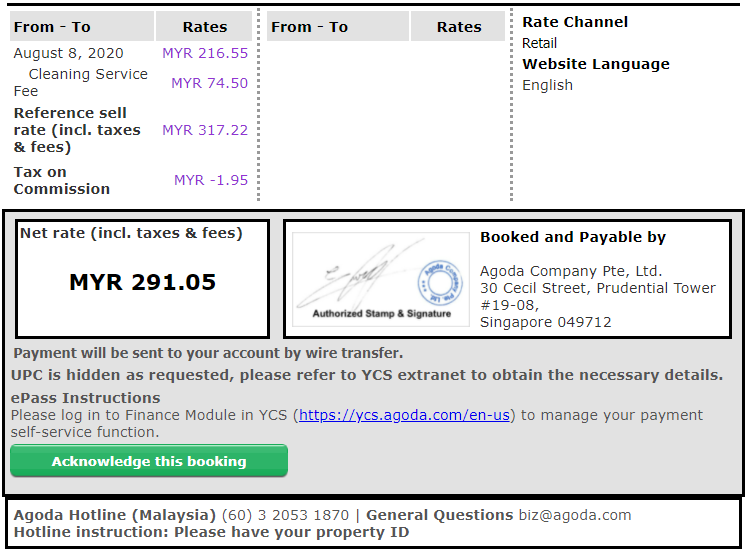

Malaysian Digital Tax Agoda Homes Host Help Center

Acct24121bbf208 Taxation Individual Assignment 2 June Chegg Com

Property Tax In Malaysia And South Africa A Question Of Assessment Capacity And Quality Assurance Semantic Scholar

Pdf Mae2013 Malaysian Taxation And Zakat Administration Orkedlili Binti Zahari Academia Edu

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Tutorial 1 Btw 3153 Tutorial 1 Question 1 I What Are The Important Characteristics Of An Studocu

Aurora Votes 2021 Prop 119 Ballot Question Asks To Increase Marijuana Tax For Private Educational Services Sentinel Colorado

This Is A Malaysia Tax Question It Is A Very Long Chegg Com

Robotax App Malaysia Personal Income Tax Form Be

Answered The Following Scenario Relates To Bartleby

0 Response to "malaysian taxation question and answer"

Post a Comment